salt tax cap new york

While other states are considering workarounds to the Tax Cut and Jobs Acts TCJA 10000 annual limit on the federal deduction for state and local taxes SALT on individual income tax returns New York became the first state to pass actual legislation. Bernie Sanders D-Vt is vowing to tweak the SALT provision perhaps by lowering the new cap to 40000 andor imposing an income limit of 400000 to benefit from it.

Calls To End Salt Deduction Cap Threaten Passage Of Biden S Tax Plan

The cap on the SALT deduction started in 2018 because of the Tax Cuts and Jobs Act a tax reform passed in 2017.

. This provision is not available for publicly traded partnerships. Lost a legal challenge to a provision of the 2017 law that limited write-offs for state and local taxes as a federal judge threw out a lawsuit seeking to block the capThe Republicans 2017 tax law capped the amount of state and local tax or SALT deductions which had been unlimited to 10000. The state and local tax deduction cap commonly known as SALT was enacted as part of President Donald Trumps 2017 tax reforms.

Bloomberg -- Four states in the eastern US. The relaxed cap an increase from the current 10000 limit would last for a decade until 2031. See what other deductions changed in 2018 How to.

Connecticut and New York have revived their efforts to overturn the SALT cap the federal deduction for state and local taxes that. The deduction was unlimited before 2018. The SALT deal appeared to remove for the time being an obstacle to passing the 185 trillion.

This was true prior to the SALT deduction cap and remained the case in 2018. This cap remains unchanged for your 2021 taxes and it will remain the same in 2022 if Congress doesnt remove the cap in its spending bill. SALT tax-cap challenge by New York and New Jersey is tossed The judge said the federal government has exhaustive power to impose and collect income taxes September 30.

Andrew Cuomos spin on the tax hikes in the state budget approved this month is this. Residents of New York. Your itemized deductions total to 26000 made up of 14k of mortgage interest 2k of charity and SALT limited to 10k because of the cap After your deductions your federal taxable income is 100000 26000 74000 which is.

The expansion of the standard deduction further limited the value of the SALT deduction for taxpayers under the 10000 cap. The New York State NYS 20212022 Budget Act was signed into law on April 19 2021. The SALT deduction tends to benefit states with many higher-earners and higher state taxes.

Democrats in Congress and some state lawmakers said the change targeted Democratic-led states that tend to have higher taxes. Download pdf 00 KB Legislation enacted by New York State will allow a New York City City partnership or resident S corporation to elect to be subject to a new 3876 entity level tax. 54 rows In 2018 only 321 percent of those filers itemized.

The Budget Act includes a provision that allows partnerships and NYS S corporations to elect to pay NYS tax at the entity level in order to mitigate the impact of the 10000 cap on SALT deductions. Unlike most states New Yorks fiscal year begins early on April 1 so it was motivated to act quickly. Since its purpose is to provide a SALT limitation workaround to New York State taxpayer individuals the tax is imposed at rates equivalent to the current and recently increased New York State personal income tax ratesthat is at 685 percent of pass-through entity taxable income of up to two million dollars with excess income taxed at rates of between 965 percent.

New York Governor Andrew Cuomo called it economic civil war. But its not entirely clear when or if that cap put in place as part of the 2017 federal tax law will actually be thrown in the wastebin by the narrow Democratic. A new bill sponsored by a pair of Democrats in the House of Representatives seeks to repeal the 10000 cap on state and local tax deductions.

Taxpayers can deduct up to 10000 of the state and local. Democrats from high-tax states like New York New Jersey and California have spent years promising to repeal the cap and are poised to lift it to 80000 through 2030 before reducing it back to. Both Gottheimer and Suozzi have been some of the most vocal advocates for SALT playing a pivotal role in getting the language to increase the cap from 10000 to 80000 into the House-passed.

When Partnership Y makes the pass-through tax election it is required to pay New York State tax in four equal installments for a total amount of 102750 1500000 x 685. SALT cap workaround enacted for 2023. The 2017 tax law capped the amount of state and local tax or SALT deductions which had been unlimited to 10000.

While the 10000 ceiling on the SALT deduction is. 11 rows The average size of those New York SALT deductions was 2103802. As originally proposed by the Governor the tax would be imposed at the rate of 685 percent 6 upon the adjusted net income of an electing pass-through entity that is doing business in New York.

The deal which was included in President Bidens sprawling Build Back Better plan late Thursday night would raise to 80000 the annual amount of state and local taxes that taxpayers can. They wont really count when the 10000 cap on state and local tax deductions is repealed by Congress. An owner of the electing entity is entitled to a credit against.

How An 80 000 Salt Cap Stacks Up Against A Full Deduction For Those Making 400 000 Or Less

How To Deduct State And Local Taxes Above Salt Cap

Tpc Analyzes Five Ways To Replace The Salt Deduction Cap Tax Policy Center

How An 80 000 Salt Cap Stacks Up Against A Full Deduction For Those Making 400 000 Or Less

What Is The Salt Cap And Why Do Some Lawmakers Want To Repeal It

Latest Proposal From Senate Democrats Would Bar The Rich From Salt Cap Relief Itep

U S Rep Brad Schneider Named To Ways Means Vows Salt Deduction Battle Deduction Battle Vows

A 25 000 Salt Deduction Cap Would Be A Modest Improvement Over The House S 80 000 Version

State And Local Tax Salt Deduction Salt Deduction Taxedu

The Salt Deduction The Second Biggest Item In Democrats Budget That Gives Billions To Rich The Washington Post

Ny State Pass Through Entity Tax A S A L T Cap Workaround Fuoco Group

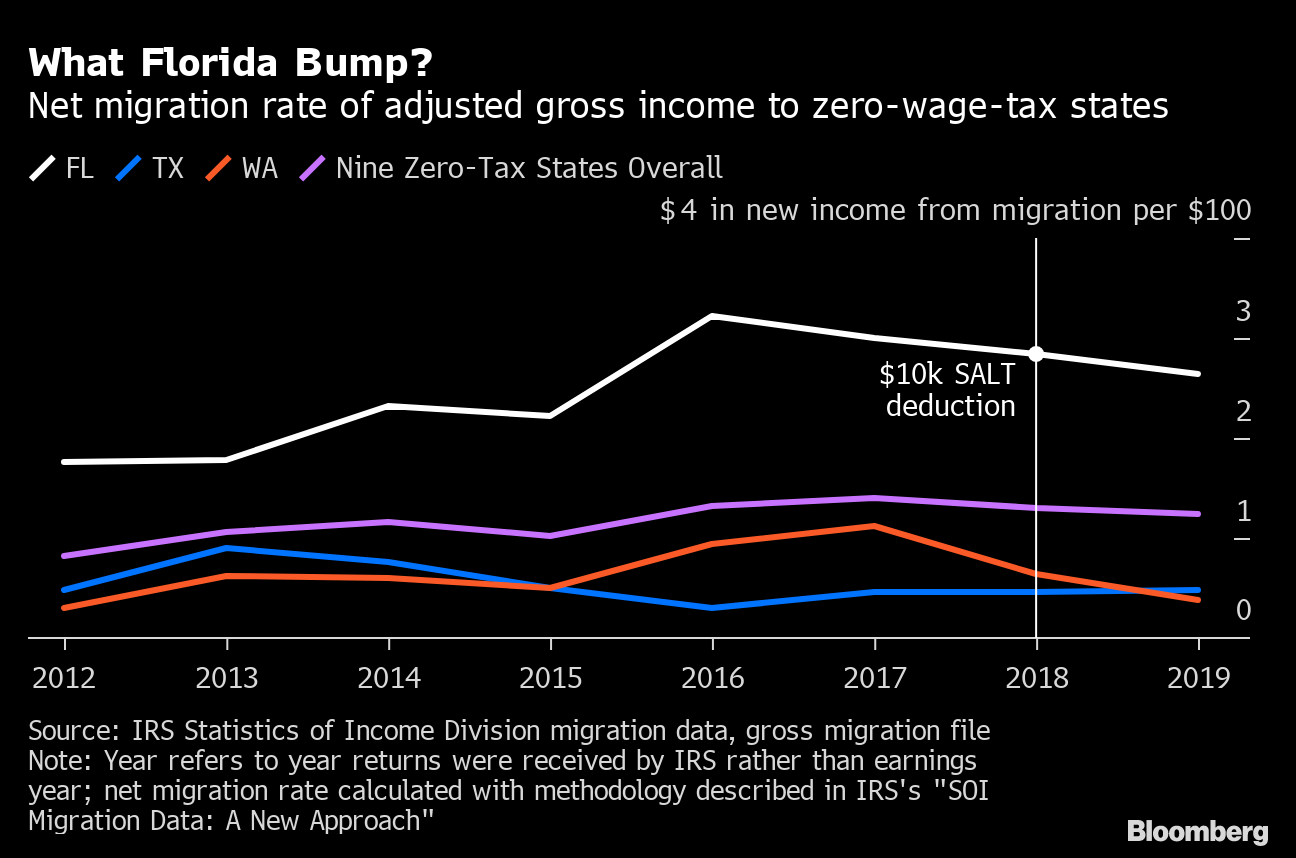

Salt Cap Confounds Doomsayers As Fears Of Exodus Prove Overblown Bloomberg

The Push To Repeal The Salt Cap The Long Island Advance

House Raises Salt Tax Deduction Cap From 10k To 80k In Build Back Better Senate Plans Changes So Millionaires Won T Get Tax Cut Yonkers Times

Salt Tax Increase That Burned Blue States Is Targeted By Democrats The New York Times

The Other Salt Cap Workaround Accountants Steer Clients Toward Private K 12 Voucher Tax Credits Itep

Tpc Analyzes Five Ways To Replace The Salt Deduction Cap Tax Policy Center

Repealing The Salt Cap Should Not Be A Top Priority In Reforming 2017 Tax Law Center For American Progress